You might think fraud is someone else’s problem—but in 2025, for many online merchants, it’s their biggest unseen cost. Fraud is growing faster than revenue in many e-commerce businesses and unless you act now, the losses will silently eat your margins.

What Happened

- The e-commerce fraud landscape is expanding rapidly: recent data shows global losses of tens of billions of dollars annually.

- Fraud tactics are evolving: synthetic identities, AI-powered bots, account takeovers, friendly fraud, triangulation, and counterfeit operations are all rising.

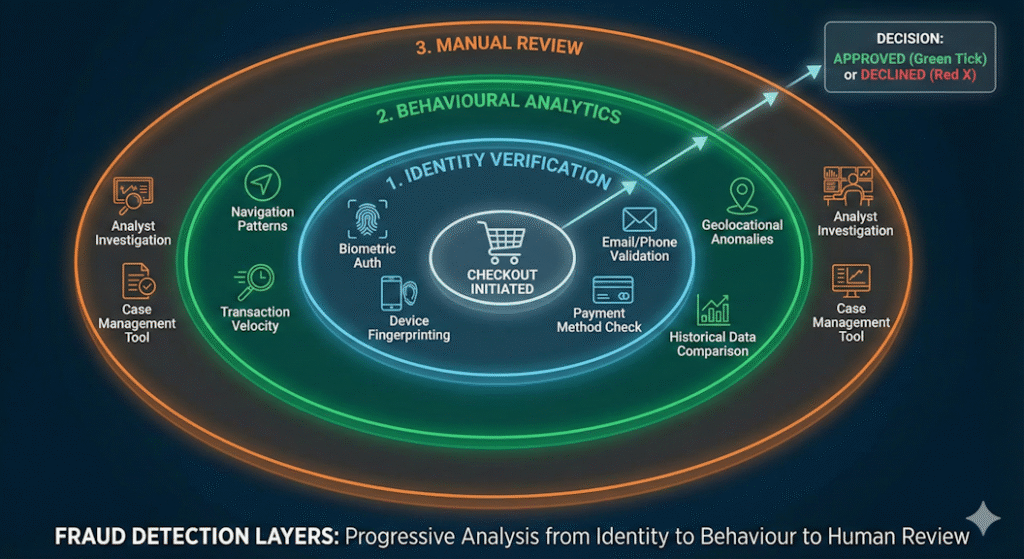

- At the same time, fraud prevention tools are leaning into AI and behaviour analytics—but many SMBs are behind the curve.

Why It Matters for Small Businesses

- Hidden cost drains: A small merchant may think they have clean operations—but fraud can quietly inflate returns, chargebacks, inventory shrink, and customer service cost.

- Reputation risk: If your store becomes a target for counterfeit goods or fraudulent purchases, you risk trust and brand integrity.

- Operational friction: Fraud forces manual reviews, holds shipments, delays fulfilment—all of which degrade the customer experience.

- Margin compression: Fraud-afflicted orders often cost more than just the value of goods—shipping, restocking, support, and lost customer goodwill all add up. For every $100 in fraudulent orders, some studies show costs totalling ~$200 in true value.

- Measurement gap: Without clear fraud metrics, you can’t optimise your funnel, inventory or acquisition channels effectively.

So, what can you do?

Here is a short, highly actionable playbook we put together to help you beat the bad guys!

Actionable Playbook (Week 1–2)

Week 1 – Audit & Quick Wins

1.Map your fraud exposure points

- New accounts (first purchase)

- High-value orders

- International shipping

- Promo code abuse

- Returns/charge2backs

2.Review your current fraud/returns metrics

- Chargeback rate

- Refund vs return vs reuse

- % of new accounts that purchase and/or return

- Manual review volume

3.Implement baseline fraud controls

- Require CVV, AVS (address verification) on payments. ([justt.ai][5])

- Device and IP velocity checks (many orders same session/device).

- Bot/fraud detection on login/checkout using captcha or behavioural signals.

4.Flag high-risk orders for review

- Orders from new account + high SKU value + international shipping.

- Pause fulfilment until manual check for first-timer high risk.

Week 2 – Build Defensible Systems

1. Deploy risk-scoring for transactions

- Build simple rule-engine: assign risk score based on account age, device, order value, shipping address, promo usage.

- Set thresholds for auto-approve, manual review, auto-decline.

- Monitor for: rapid order spikes, same shipping address across multiple accounts, multiple card tests.

- Consider a tool or plug-in if you lack internal analytics.

3. Strengthen return policy with verification

- For high-value returns: require photos or condition checks.

- Tag suspect return patterns (e.g., many returns from same account).

4. Combine with identity verification where feasible

- For expensive items, require additional ID verification before dispatch.

- Synthetic identity fraud is growing: fake names + real addresses. ([GeeTest][3])

5. Educate your team & monitor fraud trends

- Weekly review of flagged orders, outcomes, patterns.

- Maintain a “fraud log” for trends and tune your rules accordingly.

At Cerebral Ops we help SMBs build fraud-resilient commerce systems, not just reactive checklists. That means:

- Funnel and acquisition design: Understand which channels bring high-risk traffic (e.g., first-time discount hunters) and build acquisition flows accordingly.

- CRO + operations alignment: Ensure fraud controls don’t kill conversion—rules must be sharp but lean.

- Analytics & tooling: We build dashboards tracking fraud metrics, alerts when risk spikes, and modelling of cost of fraud vs prevention investment.

- Lifecycle strategy: Fraud affects retention. We help integrate fraud monitoring into customer lifecycle flows (repeat buyer signals, loyalty programs) so you don’t reward high-risk profiles inadvertently.

Examples / Use Cases

- Mid-sized apparel DTC brand: After audit, they discovered 7% of orders were flagged for chargebacks from first-time large order + international shipping. They implemented a “manual hold for new accounts >$300” rule. Result: 15% drop in fraud-related losses within 60 days.

- Marketplace seller of electronics: Identified that “triangulation fraud” (fraudster purchases with stolen card, item shipped to mule, real customer complaining) was causing inventory and shipping loss. They added device fingerprinting + shipping-address cross-check; losses dropped by ~40% in first month.

- Subscription box service: Found “friendly fraud” (customer claimed non-delivery) in 12% of all disputes. They tightened tracking, required signature confirmation above threshold, and improved customer-visibility of tracking. Chargebacks dropped 30% in next quarter.

Metrics That Matter

- Fraud loss rate – % of revenue lost to fraud/orders cancelled/refunded.

- Chargeback rate – aim <1% of total transactions (varies by industry).

- Fraud detection ratio – % of flagged orders that were actually fraudulent.

- Manual review volume & cost – time and cost per reviewed order, aim to decrease.

- Conversion friction rate – % of legitimate orders delayed by fraud controls; aim to minimise.

- Repeat-customer trust score – % of orders from returning buyers without fraud flags.

Risks & Constraints

- Friction vs conversion trade-off: Over-zealous rules kill good orders—balance is key.

- Tooling cost: Some advanced fraud tools require budget and integration; SMBs must prioritise.

- False positives: Flagging too many legitimate orders creates service issues and harms experience.

- Data privacy/regulation: Using behavioural and identity data means you must comply with GDPR/CCPA/Indian privacy rules, depending on your geography.

- Evolving attacker tactics: Fraudsters adapt fast; this is ongoing, not “set & forget.”

How we can help you

If you’re running an online store and want a fraud-resilience audit — covering acquisition channels, order patterns, manual review bottlenecks and cost of fraud metrics — let’s map a 4-week plan for you.

We will give you a plan to do it – or we can also do it for you if you are short of time or manpower! Just reach out to us at https://cerebralops.in/contact.html .

Sources

- Help Net Security “The fraud trends shaping 2025: Pressure builds on online retailers.” https://www.helpnetsecurity.com/2025/07/23/biggest-fraud-trends-2025/

- ClickPost “Ecommerce fraud statistics: Key Trends & Insights for 2025.” https://www.clickpost.ai/blog/ecommerce-fraud-statistics

- Justt Blog “Ecommerce Fraud Detection & Prevention.” https://justt.ai/blog/ecommerce-fraud-prevention/

- Geetest “Smart e-commerce fraud prevention tactics for 2025.” https://www.geetest.com/en/article/ecommerce-fraud-protection